CERTANIA Announces Growth Capital Raise from Summit Partners

Munich, Germany (28 August 2023) – CERTANIA Holding GmbH (“CERTANIA” or “the Company”), a provider of Testing, Inspection, and Certification (TIC) services focused on addressing global challenges across health and sustainability, today announced a growth investment from Summit Partners.

The funding will be used to further support CERTANIA’s acquisition strategy and help position the Company as a leading TIC provider in Europe and beyond. Founding investor GREENPEAK Partners will maintain significant equity ownership in the Company. Financial terms of the transaction are not disclosed.

Founded in 2020 and based in Munich, Germany, CERTANIA united leading companies in its field to form a new independent market player with a global footprint serving customers across the whole chain of TIC services. From the beginning, the Company has focused serving two key market sectors: health and sustainability, putting human well-being and a functioning environment at the center of its mission. Under the CERTANIA umbrella, partner companies benefit from shared operational infrastructure and improved customer confidence that may otherwise prove elusive to smaller operators – all while maintaining their unique identity and entrepreneurial spark.

“This investment is a testament to our commitment to drive positive change in the TIC landscape,” said Karsten Xander and Moritz Gruber, co-CEOs at CERTANIA . “We believe that, by fostering collaboration among independent experts and focusing on sustainability and health consciousness, we can create visible value for our partners, clients and the wider community. Summit Partners’ engagement will help boost our global development. We look forward to benefiting from their deep experience in the TIC market and to maintaining the well-established and trustful relationship with GREENPEAK Partners as specialists for entrepreneurial company building.”

Today, CERTANIA includes sixteen partner companies and employs more than 1,000 professionals across the globe. The Company offers an extensive portfolio of services, including expertise in the areas of food, environmental and industrial testing, CRO services, ESG analytics and consulting, and a broad range of certification and quality-control services, all with the goal of helping clients ensure the safety and quality of their products and processes.

“CERTANIA has achieved impressive scale in just three years since the Company’s founding, and we believe the platform offers a unique opportunity for independent TIC providers who are looking to expand their reach and impact,” said Johannes Grefe, Managing Director at Summit Partners who will join the CERTANIA Board of Directors. “We are thrilled to partner with this visionary team and look forward to working together with co-CEOs Karsten and Moritz and Daniel Beringer at GREENPEAK to build upon CERTANIA’s impressive momentum and support continued organic and acquisition-driven growth.”

“We are excited and honored to have Summit Partners by our side,” added Daniel Beringer, Founding Partner at GREANPEAK Partners. “Together, we will continue to focus on making our planet more sustainable and healthier by expanding CERTANIA’s reach geographically and by growing its service offerings to its customers.”

The transaction is subject to regulatory approval and is expected to close in Q4 2023.

About CERTANIA:

Under the umbrella of CERTANIA Holding GmbH, a new global market player is created in the field of Testing, Inspection & Certification as well as scientific, laboratory and compliance services. This group offers medium-sized partners a sustainable home for their life’s work. CERTANIA enables entrepreneurs and owners to further develop their companies with like-minded people, while continuing to preserve their entrepreneurial roots, corporate culture, brand and values.

For more information visit the website www.certania.de

About GREENPEAK:

GREENPEAK Partners is a company builder with proven track record and comprehensive expertise in the foundation, development, and expansion of industry leaders. While executing its Buy & Build strategies, GREENPEAK aims to develop industry leaders by virtue of strong partnerships, ESG values, and aligned sustainable interests.

To date, the GREENPEAK Partners team has built over 10 platforms, with annual revenues exceeding €1 billion. For more information, please see www.greenpeak-partners.com or Follow on Linkedin.

About Summit Partners:

Founded in 1984, Summit Partners is a global alternative investment firm that is currently managing more than $37 billion in capital dedicated to growth equity, fixed income and public equity opportunities. Summit invests across growth sectors of the economy and has invested in more than 550 companies in technology, healthcare and other growth industries. Summit maintains offices in North America and Europe, and invests in companies around the world.

For more information visit the website www.summitpartners.com

SGI Holdings Ltd. sells its continental European business to CERTANIA

Established in 1985, SGI Compliance has a rich history which has led the company to develop into a well-known market player with a large and loyal customer base in the Netherlands, Norway, Belgium and France. SGI Compliance specializes in services related to carcinogenic, mutagenic or reprotoxic (CMR) hazardous chemicals, as well as water hygiene. In 2019, LDC, a leading private equity firm, invested

to back the management buyout of SGI Compliance from the global testing, inspection and certification group, Kiwa. This also included its activities in the UK, operating under the name HSL Compliance.

CERTANIA is a rapidly growing testing, inspection, and certification (TIC) provider with a mission to support its customers as an independent partner, promoting quality, sustainability and health transparency in companies and their ecosystems. CERTANIA operates across various segments, including life science, food & environment, ESG advice & analytics, certification & verification, sustainable materials and structures. CERTANIA is backed by GREENPEAK Partners.

CERTANIA will leverage its expertise in water hygiene services in order to strengthen this segment within SGI Compliance. Conversely, SGI Compliance’s hazardous materials experience will be integrated into CERTANIA’s core geographies, utilizing the existing infrastructure as a launch pad while maintaining the management team at SGI Compliance.

“CERTANIA is known for its pragmatic customer-centric approach and commitment to environmental, social, and governance (ESG) principles. The mission and vision of SGI Compliance align seamlessly with CERTANIA’s approach. Under the umbrella of CERTANIA, SGI Compliance will continue to operate independently, leveraging the synergies and growth opportunities arising from our partnership”, says Sytze Voulon, CEO of SGI Compliance.

Moritz Gruber, managing director of CERTANIA: “We are delighted to welcome SGI Compliance to CERTANIA. While we operate as one cohesive company, our philosophy emphasizes local empowerment and values managers with a strong entrepreneurial spirit. Our plan is to maintain SGI Compliance as an independent entity while fostering collaboration, providing management support, and actively contributing to the company’s development.”

About CERTANIA:

Under the umbrella of CERTANIA Holding GmbH, a new global market player is created in the field of Testing, Inspection & Certification as well as scientific, laboratory and compliance services. This group offers medium-sized partners a sustainable home for their life’s work. CERTANIA enables entrepreneurs and owners to further develop their companies with like-minded people, while continuing to preserve their entrepreneurial roots, corporate culture, brand and values.

About SGI Compliance:

SGI Compliance is a European risk and compliance leader, specialising in water, hazardous materials, fire safety and associated Health Safety and Environmental services. It runs operations in Norway, the Netherlands, Belgium and France and serves customers such as energy providers, commercial real estate companies, maritime companies and industrials.

About GREENPEAK Partners:

GREENPEAK Partners is a company builder with proven track record and comprehensive expertise in the foundation, development, and expansion of industry leaders. While executing its Buy & Build strategies, GREENPEAK aims to develop industry leaders by virtue of strong partnerships, ESG values, and aligned sustainable interests. To date, the GREENPEAK Partners team has built over 10 platforms, with annual revenues exceeding €1bn.

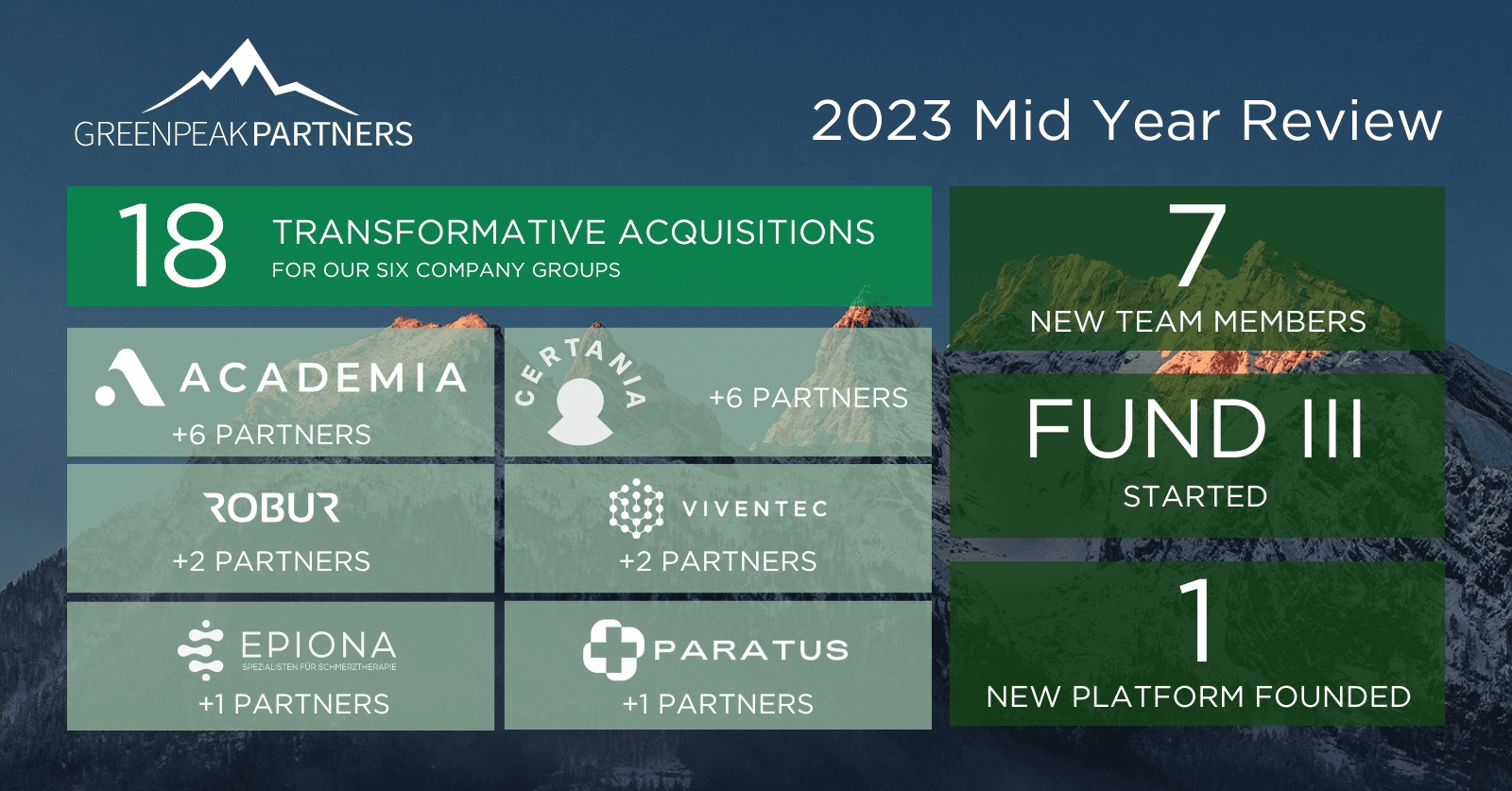

Celebrating a Successful First Half of the Year!

GREENPEAK Partners Proudly Joins ESG Data Convergence Initiative for Second Year

The EDCI brings together stakeholders from the private equity industry with the objective to harmonize ESG data, set common standards and provide valid benchmarks for private markets.

“The collaborative effort of the initiative is highly aligned with GREENPEAK’s purpose of “Building sustainable businesses and partnerships”, says Daniel Beringer, Managing Partner at GREENPEAK Partners. “By joining forces with the 300+ EDCI members, we contribute to enhancing transparency, comparability, and ultimately drive more impactful sustainable investing practices.”

As further proof of its thorough commitment to ESG integration, GREENPEAK Partners has successfully fulfilled the maximum number of ESG thresholds required by the debt provider for three of GREENPEAK’s Buy & Build platforms. This reflects the firm’s dedication to fulfill the highest ESG standards beyond the norm.

” GREENPEAK Partners has developed a state-of-the art ESG framework and integrates it across all investment activities,” states Valentina Stadler, ESG Officer at GREENPEAK Partners. “Reaching maximum ESG thresholds highlights the dedication to aligning financial performance with positive environmental and social outcomes.”

By participating in the ESG Data Convergence Initiative and exceeding ESG thresholds, GREENPEAK Partners demonstrates its proactive approach to fostering partnerships, building networks and maintaining ambitious ESG standards.

ABOUT GREENPEAK PARTNERS

GREENPEAK Partners is a company builder with proven track record and comprehensive expertise in the foundation, development, and expansion of industry leaders within the German, Austrian, and Swiss markets. While executing its Buy & Build strategies, GREENPEAK aims to develop industry leaders by virtue of strong partnerships, ESG values, and aligned sustainable interests.

To date, the GREENPEAK Partners team has built 7 platforms, with annual revenues exceeding €500m.

For more information on GREENPEAK Partners, please refer to its website: www.greenpeak-partners.com & our ESG policy.

New GREENPEAK Offices in London & Munich

GREENPEAK 2022 – Year in review

As we come to the end of another eventful year, it is time to reflect on the successes, challenges and changes that have shaped our business in 2022.

Fund II successfully completed

12 new team members

2 new ESG and sustainability initiatives

1 new business group

17 transformative acquisitions

Here’s to a successful 2023!

GREENPEAK Partners successfully closed its Fund II in July 2022

- GREENPEAK Partners Fund II GmbH & Co. KG (the “Fund”) closed on 29 July 2022 with EUR 150m-200m in deployment capacity within Fund II incl. co-investments

- The Fund is an aspiring SFDR Article 8 fund

- Fund II has made five platform investments and is now focusing on add-ons; it expects to make three to five add-ons per platform per year

- GREENPEAK invests EUR 30m-50m of equity per platform company, with EUR 3m-20m deployed per add-on

- The Fund portfolio companies include Academia, Certania, Epiona, Viventec, and Paratus

- Ely Place and Acanthus were acting as placement agents for the fundraise of GREENPEAK Fund II

- Orbit Fund Boutique was acting as legal counsel for the Fund

On the Fund’s strategy

GREENPEAK Partners Fund II follows an ESG theme-led, entrepreneurial Buy & Build strategy driving consolidation in attractive and pre-identified service niches in the DACH market. We specialise in three industrial areas: healthcare, business services, and services for real assets. GREENPEAK seeks value-creation through technology employment in these sectors capitalizing on the mega-trends of environmental and longevity that Europeans care so much for.

We team up with buy-in entrepreneurs and seek to acquire stable cashflow generating companies forming sustainable partnerships between them and thereby building up larger businesses. We always invest into cashflows at fair market valuations, build solid service groups where the re-investing sellers, managing directors, and employees find a home with greater stability also when sailing against economic headwinds.

On GREENPEAK Partners

GREENPEAK Partners is a company builder with proven track record and comprehensive expertise in the foundation, development, and expansion of industry leaders within the German, Austrian, and Swiss markets. While executing its Buy & Build strategies, GREENPEAK aims at developing industry leaders by virtue of strong and close partnerships, ESG values, and aligned sustainable interests.

Throughout the years, the GREENPEAK Partner team has built 8 platforms, all flourishing today, with annual revenues of over €750m.

The founding and managing partners Daniel Beringer, Florian Kopp, Jens Cremer and Dr. Michael Ruoff lead the strategic and operational business of GREENPEAK.

Greenpeak Partners on emerging manager fundraising and specialisation

By Harriet Matthews, published at unquote.com

As Greenpeak Partners wraps up the final close of its second fund, managing partner Daniel Beringer speaks to Unquote about the Munich-headquartered GP’s latest fundraise and its focus on healthcare, business and real assets services buy-and-build.

Beringer did not disclose the expected final close amount, for Greenpeak Fund II, but said that the GP should have EUR 150m-200m in deployment capacity with Fund II plus co-investments. It previously raised EUR 110m for its debut fund.

Ely Place and Acanthus have acted as placement agents for the fundraise of vehicle, which is an Article 8 fund under the SFDR.

“We felt that raising around EUR 150m in total capital was a realistic goal, ”Beringer said. “We thought we might get it there a little but faster at the start, but we took half a year longer in the current environment as we are a new fund. We have an almost overperforming portfolio, but with so many large funds drawing money, you need the track record and credibility to raise money – people’s capacity for trial and error is decreasing.”

The GP is well aware that the current market has been, and continues to be, a particularly tough one for emerging managers. “The industry has professionalised and the only strategy as a small fund you can go for is specialisation,” Beringer said. “We specialise in buy and build in three areas: healthcare; and business services, and services for real assets. Technology is engrained into these, and in both sectors, the trend we believe makes sense for us is the environmental and longevity trends that Europeans care so much for.”

Greenpeak’s investment strategy has left its portfolio relatively well insulated from the current market, according to Beringer. “We always acquire cashflow generating companies and build up larger companies from this,” he said. “We have always invested into cashflows at sensible single-digit multiples, so we aren’t suffering so much from multiple compression.”

Its investment themes have also offered a form of buffer from the current cycle, Beringer said. “There is always some cyclicality out there, and consumer preference can change – but people still go to the doctors, and the environment still needs protecting. The trend drivers are higher than the GDP growth drivers.”

Building platforms

Fund II has made five platform investments and is now focusing on add-ons; the GP expects to make three to five add-ons per company from the fund. Greenpeak generally makes 20 deals per year, including add-ons for its portfolio, Beringer said.

Greenpeak typically invests EUR 30m-50m per platform company, with EUR 3m-20m deployed per add-on. It targets businesses based in the DACH region with EBITDA of EUR 500,000-5m and revenues of EUR 5m-50m, according to its website. It focuses on businesses with strong management teams.

The fund’s portfolio companies include laboratory data group Academia, ecological testing, inspection and certification provider Certania, building technology service provider Viventec, and healthcare software and IT provider Paratus.

“HVAC buy-and-build for Viventec is a big topic for us at the moment, particularly given the possibility we will be cut off from Russian gas,” Beringer said. “We foresaw houses getting greener, but we didn’t foresee Russia’s war with Ukraine. We are seeing good growth and a lot of interesting opportunities for Certania, too, which focuses on ESG testing and inspection, and there are similar opportunities for Robur.”

Robur is an industrial service provider that focuses on assisting companies with digital transformation and ecological change. Its services include planning and realisation, operation and maintenance, relocation, and dismantling and disassembly. The GP owns the company via its debut fund.

“We are still debating whether we want to exit any of our portfolio, it could definitely still happen this year,” Beringer said. “The development of our businesses is favourable, but the market might not be favourable for exiting.”

Aside from deals, the GP’s future plans include preparing for its next fundraise. “We will discuss raising the next fund in September or October as it depends on our deployment,” Beringer said. “If we deploy fast, we could come to the market earlier, but a reasonable goal would be 2023.”

© Mergermarket Limited, 10 Queen Street Place, London EC4R 1BE

GREENPEAK Partners becomes a signatory to Initiative Climat International (iCI)

GREENPEAK Partners is pleased to announce it has become a signatory to Initiative Climat International (iCI). The decision to join iCI is an important step on GREENPEAK’s sustainability journey, reflecting its deep commitment to integrating ESG principles in its investment thesis.

iCI is a platform of leading private equity investors under the umbrella of the UNPRI dedicated to play a crucial part in reducing carbon emissions from private equity-backed companies. iCI signatories commit to jointly work towards reaching the goals of the 2015 Paris agreement on limiting CO2 emissions. Collaboration is a key driver for iCI. Its members commit to sharing best practice, key learnings and resources to accelerate change.

Daniel Beringer, Managing Partner of GREENPEAK Partners states: “GREENPEAK’s investment philosophy is highly aligned with iCI’s collaborative approach of experience sharing and working together towards a common goal. Our focus on establishing a partnership culture in the businesses we build allows us to scale the efforts to reach the goals of the Paris Agreement.”

Michael Ruoff, Managing Partner of GREENPEAK Partners adds: “We recognize that climate change will have an adverse effect on the global economy. This generates both risks and opportunities for our investments which we have committed ourselves to address in the best possible way.”

Valentina Stadler, ESG Officer, GREENPEAK Partners highlights: “We at GREENPEAK Partners are deeply committed to a sustainable future. ESG is deeply engrained in our corporate culture and an integral part of our investment DNA. Joining forces with other iCI members on addressing climate change will propel us forward in reaching our key ESG goal to reduce GHG emissions across all GREENPEAK companies.”

GREENPEAK Partner’s commitments include

- As a member of the Initiative Climate International (iCI), we have joined forces with the international private equity community to contribute to The Paris Agreement to limit global warming to well below two degrees celius, and in pursuit of 1.5%.

- We will actively engage with our partner companies to establish measurement of their CO2 emissions and set an ambitious, but realistic reduction target – and will do the same for ourselves at fund level.

- We will support and promote the iC International among private equity firm peers.

GREENPEAK Partners is a team of investment professionals driven by our purpose to “build businesses and partnerships”. We believe that a sustainable economy is built by entrepreneurs with a vision to combine economic success with the achievement of ecological, social and governmental (ESG) criteria beyond today’s standards. We are a company builder with proven track record and comprehensive expertise in the foundation, development, and expansion of industry leaders within the German, Austrian, and Swiss markets. While executing its Buy & Build strategies, GREENPEAK aims at developing industry leaders by virtue of strong and close partnerships, ESG values, and aligned sustainable interests.

For more information on GREENPEAK, please refer to our website & our ESG policy.

Yesterday, Great Place to Work held its online awards ceremony for the best employers with more than 50 employees, where St. Vinzenz Allgäu learned about its rankings:

(Companies with 251-500 employees)

(Companies with 251-500 employees)

(Clinics with 50 or more employees)

(Companies with 251-500 employees)

(Companies with 251-500 employees)

(Companies with 251-500 employees)

(companies with 50 or more employees)

(Companies with 251-500 employees)

St. Vinzenz Allgäu was recognized for the first time as one of the best employers in Germany in a cross-industry comparison. In Bavaria and the Allgäu region, no distinction is made between sectors either. In addition, as in 2009, 2012, 2015 and 2018, the award was given in the category of hospitals, in which hospitals from all over Germany are evaluated. A total of 149 companies from all over Germany were honored yesterday.